How Drop Deck Trailers Qualify for Section 179 Tax Savings in 2025

- Oct 20, 2024

- 3 min read

Updated: Aug 21, 2025

Updated for 2025 Tax Year

If you’ve been considering a Drop Deck Direct trailer, now may be the smartest time to buy. Thanks to Section 179 of the IRS tax code, you can deduct the full cost of your trailer in the year you put it into service — instantly lowering your taxable income while investing in equipment that makes your business safer and more efficient.

Unlike generic tax write-offs, Section 179 directly applies to drop deck trailers. That means your investment in safer loading, better efficiency, and reduced labor costs can also bring immediate tax savings.

How Section 179 Works for Trailers

Here’s the simple version: when you purchase qualifying equipment and place it into service in the same tax year, you can deduct 100% of the purchase price up to the annual limit. For 2025, that limit is $1.25 million, with a phase-out beginning after $3 million in total equipment purchases.

✅ Yes, trailers qualify.

✅ Yes, both new and used equipment count.

✅ Yes, financing still allows the deduction.

For a full breakdown of Section 179 rules and updates for 2025, visit our Complete Section 179 Deduction Guide.

Why Drop Deck Direct Trailers Are the Perfect Section 179 Purchase

Most contractors, municipalities, and rental companies already need a trailer for hauling scissor lifts, forklifts, HVAC units, or heavy cargo. Section 179 simply makes it more affordable to buy the right trailer now instead of waiting.

Key Benefits of Our Hydraulic Drop Deck Trailers:

Ground-Level Loading – No more risky ramps or steep inclines.

Safer Operations – Reduce the chance of worker injuries when loading equipment.

Faster Turnaround – Save labor hours every week by streamlining loading and unloading.

Durability – Built tough to withstand daily use in construction, rental, and municipal work.

By pairing these operational advantages with Section 179 savings, many of our customers recover thousands in the first year alone.

Real-World Example of Trailer Tax Savings

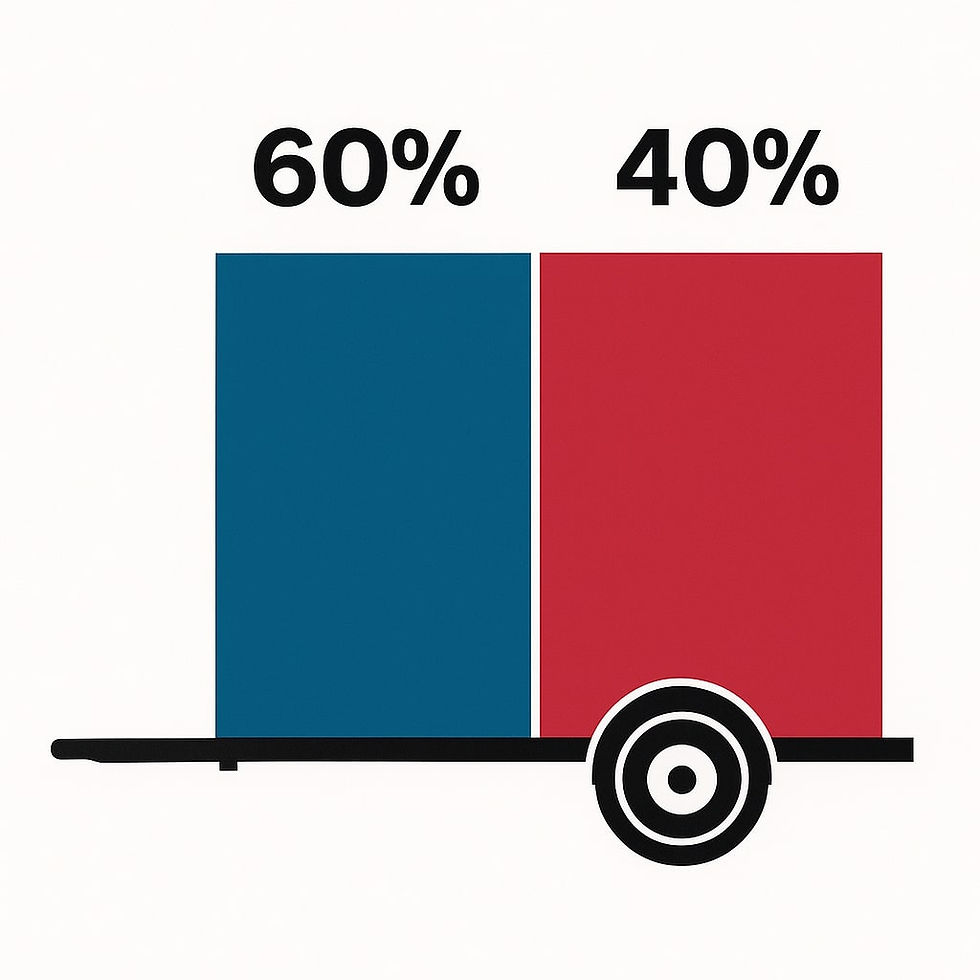

Let’s say you purchase a $30,000 hydraulic drop deck trailer in 2025:

Purchase Price: $30,000

Section 179 Deduction: $30,000

Estimated Tax Savings (at 21% rate): $6,300

That’s $6,300 you keep in your business while gaining a piece of equipment that improves safety and efficiency every day.

Who Benefits Most?

We’ve helped businesses in many industries apply Section 179 to their trailer purchases:

Contractors – Electricians, HVAC, and plumbing companies hauling lifts or materials.

Rental Companies – Deduct trailers used daily for customer equipment transport.

Municipalities – City and county fleets expanding capacity for maintenance and public works.

If your trailer is used 50% or more for business, Section 179 applies.

FAQs: Section 179 and Drop Deck Direct Trailers

Q: Does an enclosed drop deck trailer qualify the same way as an open trailer?A: Yes — as long as it’s used for business purposes more than 50% of the time.

Q: What if I finance my trailer?A: You can still deduct the full purchase price under Section 179, even if you haven’t finished paying off the loan.

Q: Can accessories like E-track or side kits be included?A: If purchased and installed with the trailer, those accessories typically qualify as part of the deduction.

Why Now Is the Right Time

The IRS requires that equipment be purchased and placed into service by December 31, 2025 to qualify for this year’s deduction. Waiting until Q4 can mean longer production lead times and potential delays — so the earlier you order, the better.

Don’t wait until December rush season. Secure your trailer now, put it to work, and lock in your tax savings before year-end.

Conclusion: Turn Your Trailer Into a Tax-Smart Investment

Buying a Drop Deck Direct trailer isn’t just about equipment — it’s about making a tax-smart investment that reduces risk, improves efficiency, and puts cash back in your pocket.

Ready to see how much you could save? Use our Section 179 calculator or talk to your CPA today, then Build & Price Your Trailer with Drop Deck Direct to maximize your savings.

Comments